On July 1, 2015 the “Healthy Work Places, Healthy Families Act of 2014” came into force in California. One of the provisions under this act was the entitlement to mandatory paid sick days for about 6 million workers in California. In it’s simplest terms, employees can accrue 1 hour of sick leave per 30 hours worked, given that they work at least 30 days in the year and subject to a 90 day probation period. Employers are entitled to cap the accrual amount to a maximum of 3 days (24 hours) per year but can allow for more, and in fact, the accrual scheme allows employees to accrue more than the 3 days per year. The act also allows employees to carry sick leave into the next year but allows for a cap of 6 days or 48 hours, basically two years worth of sick days.

There’s a very detailed Q&A information page on the California Department of Industrial Relations Website here. It covers issues such as which employees are eligible, how many days of work are required for eligibility, and employer reporting requirements. Regarding those it says:

Employers must show, on your pay stub or a document issued the same day as your paycheck, how many days of sick leave you have available. Employers also must keep records showing how many hours you earned and used for three years. This information may be stored on documents available to employees electronically.

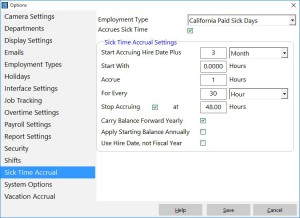

Time Clock MTS can be used to automatically accrue, track, and report on these new paid sick days. The exact method you’d use would vary based on how employers decide to implement paid sick days, but in it’s simplest form a sick leave accrual scheme would:

- Have a 90 day eligibility period.

- Have an accrual start date of 7/1/2015 for an existing employee.

- Cap annual accruals at 3 days.

- Carry hours forward on yearly rollover.

- Cap total accrual amount to 6 days.

A sick leave accrual scheme in Time Clock MTS that complies with each of these rules could be setup easily and would look like the screenshot below:

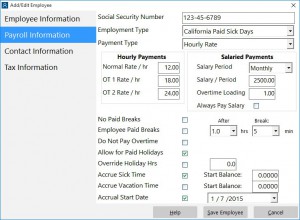

You’d also need to assign the employees to the correct accrual scheme and set their accrual start date to 7/1/2015. You can do that via each employee’s Payroll Information screen (see image below).

If you’re not sure what accrual schemes are in Time Clock MTS and how you’d use it to record sick days then you should read read this article on sick time accruals and this article on using Time Clock MTS to record sick time taken.

To comply with the reporting requirements you’re going to need to setup the “Accrual Information” report section template on the report settings screen. You’ll need to make sure you include the data fields <SICK_TIME_TAKEN_PERIOD> and <SICK_TIME_TAKEN_PERIOD> in the section template somewhere. Something like this would work:

Sick Days:

Sick Time Taken: <T><SICK_TIME_TAKEN_PERIOD> hrs (report period)

Sick Time Owing: <T><SICK_TIME_OWING> hrs

You can make this information available to employees directly from within Time Clock MTS by allowing them to view their own time cards.